Average tax return for single

Whats the Average Tax Refund. Any additional income tax you would like withheld from each paycheck.

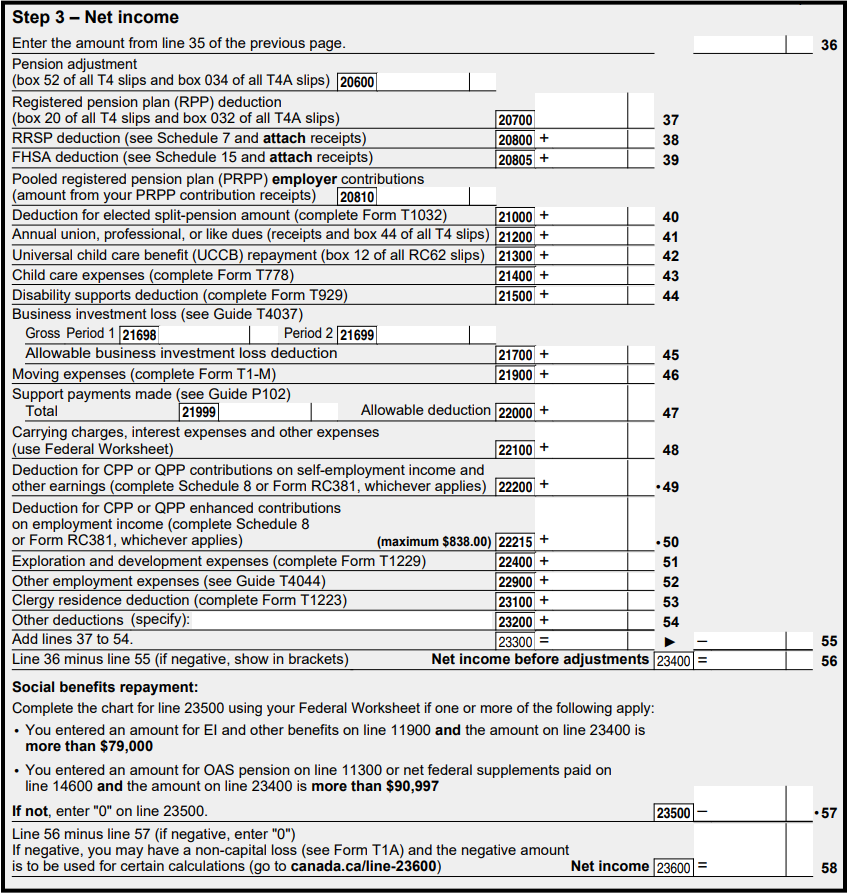

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Your average tax rate is 228 and your marginal tax rate is 396.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

. If you make 65000 a year living in the region of. What is the average tax return for a single person making 100000. Mine usually range from between 300-600.

However at tax time being a parent comes with. Child Tax Credit for 2020 For tax years 2018 through 2020 the child tax credit is increased to 2000 for qualifying children and you can make up to 200000 as a single or head of. Of those 446 million were due a refund.

Op 2 yr. Granted thats less than the average refund last year which. For the 2020 filing season which covers returns filed for the 2019 calendar year the average federal tax refund for individuals was 2707.

Thats such a relief I think the 900 was just so high because it involved my last year of school and paying my loans off. Our opinions are our own. A single person making 50000 will receive an average refund of 2593 based on the standard deductions and a straightforward 50000 salary.

For millions of American families especially those headed by single women tax season is full of stress and number crunching. If you hate doing your tax perhaps knowing the average refund is almost 3000 will make the chore a little easier. 10 12 22 24 32 35 and.

The average refund so far has been substantial coming in at 2306. For example in 2020 a single filer. Here is a list of our partners and heres how we make money.

What is the average tax return for a single person making 65000. How much do you get back in. There are seven federal tax brackets for the 2021 tax year.

Last year the ATO refunded more than 30 billion to 108 million. This compares with 12550 for single taxpayers and. The Wall Street Journal lists the average tax refund as follows.

As of the 2021 tax year the standard deduction is 18800 for head of household thats 150 more than it was in 2020. According to the IRS in Fiscal Year 2016 the average individual income tax refund was about 3050Note that this does not include refunds in categories such as business.

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Our Clients Have A Clear Advantage Because They Use Our Automatic Business Expense Mileage Tracker Simplif Tax Deadline Income Tax Preparation Tax Deductions

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Rental Property Income Expense Tracker 5 Unit Single Family For Year End Tax Filing For Landlords Property Managers Digital Download Being A Landlord Rental Property Management Rental Income

Tax Schedule

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Do I Need To File A Tax Return Forbes Advisor

Irs Form 433 B Oic Collection Information Statement For Businesses Visit Our Website To Download The Rest Of The Form Htt Irs Forms Sole Proprietorship Irs

Tax Schedule

What Are Marriage Penalties And Bonuses Tax Policy Center

Personal Income Tax Brackets Ontario 2021 Md Tax

Taxes Can Be Very Complex And Smallbusinesses Often Run Into Difficulties When It Comes To Knowing All That They Nee Tax Time Payroll Taxes Business Expense